Purchasing an electric bike can represent a significant investment for many individuals and businesses. Fortunately, there are various incentives and financial aid available to facilitate the acquisition of such an eco-friendly vehicle. Let's discover together the aid you are eligible for.

Following the publication of Decree No. 2024-1084 of November 29, 2024, all subsidies for the purchase of a bicycle (whether electric or muscular) at the national level will be eliminated from February 14, 2025.

Go directly to the section that interests you :

Professionals: an update on aid and tax reductions

Can my employer help me purchase an electric bike?

Buy your bike with an advantageous loan

Assistance with purchasing an electrically assisted bicycle

First of all, it's important to know that electric-assisted bicycles, also known as e-bikes, are eligible for various purchase subsidies. These subsidies are implemented by the state and local authorities to encourage the use of gentle, non-polluting modes of transport.

The main types of aid for purchasing an electric bike, known as ecological bonuses, subsidies, or grants, can be paid in the form of a partial refund of the purchase price or a direct reduction on the price of the bike. The amount of aid may vary depending on your use (professional or personal), your place of residence, and the type of bike: classic, folding, cargo, electric mountain bike, etc., and the applicant's financial circumstances.

To benefit from this assistance, it is generally necessary to put together an application file including certain supporting documents such as a purchase invoice, a sworn statement of residence or proof of address. Some assistance schemes may also require a copy of the vehicle identification card (issued during the bicycle's bicycode identification) or a document proving that the bicycle is eligible for the requested assistance. It should also be noted that this assistance can often be combined with other soft mobility assistance schemes. For example, if you already benefit from assistance for the purchase of an electric vehicle (car, electric scooter, etc.), you may also be able to benefit from assistance for the purchase of an electric bicycle.

However, it is important to note that some aid may be capped in terms of amount. In addition, some aid is reserved for low-income households, in order to encourage people on the lowest incomes to opt for this environmentally friendly mode of transport.

Finally, it is essential to take into account the technical specifications of the electric bike when purchasing it. It is recommended to choose a bike with a lithium battery, which is more efficient than a lead battery, and to check the maximum power of the electric motor . In short, to find out about aid for purchasing an electric bike, it is best to inquire beforehand with local authorities, urban communities and regions. These aids help reduce the cost of purchasing an electric bike and thus encourage people to opt for this ecological, economical mode of transport, which is ideal for short journeys and urban travel.

Looking for the electric cargo bike of your dreams? Check out our comparison of the best electric cargo bikes in 2024.

National level grants

The Bicycle Bonus in 2024

Faced with the growing challenges of car traffic, many major French cities have been considering ways to encourage bicycle travel for several years. As a result, more and more local authorities are allowing their citizens to benefit from financial support for the purchase of an electric bicycle. In addition to these local schemes, the State offers the bicycle bonus .

The amount of this aid varies from €300 to €400 depending on the reference taxable income and can be combined with other public and territorial aid. Note that a person can only benefit from this aid once.

And don't forget , if you are considering replacing your polluting vehicle with an electrically assisted bicycle, additional assistance is available: the conversion bonus.

Who can benefit from the bicycle bonus?

- Adults residing in France, with a taxable income per share less than or equal to €15,400.

- People with disabilities who benefit from various forms of assistance such as the Disabled Adult Allowance (AAH), the Disability Compensation Benefit (PCH), the Increase for Independent Living (MVA), the Disabled Child Education Allowance (AEEH), or who hold disability cards.

Which bikes are eligible for the bonus?

The purchased bicycle must meet the following criteria:

- Be new or used , purchased from a professional seller.

- Do not use lead acid batteries.

- Be a pedal-assisted cycle or a conventional cycle if the taxable income per share is less than or equal to €7,100, or if the buyer is disabled.

- This includes electric or classic folding, cargo, recumbent, handicapped-adapted bicycles, as well as electric trailers.

- Not to be resold within one year of purchase and have a unique identifier marked on the frame.

How much is it?

The amount of aid varies depending on the situation, within the limit of 40% of the acquisition cost :

- €150 for a classic bicycle purchased by a person with a taxable income per share of less than or equal to €7,100.

- €300 for a pedal-assisted bicycle purchased by a person with a taxable income per share of less than or equal to €15,400.

- €400 for a pedal-assisted bicycle purchased by a person with a taxable income per share of less than or equal to €7,100.

- €1,000 to €2,000 for bicycles fitted out for the transport of people or goods, cargo bikes, longtails, cargotails, folding bikes or electric trailers, by a natural person whose reference tax income per share is less than or equal to €15,400.

How to apply?

The application must be submitted within six months of purchase, online on the dedicated website: primealaconversion.gouv.fr .

The application must include the following documents (others may be required depending on the situation):

- Valid ID.

- Recent proof of address.

- Bicycle purchase invoice.

- Tax notice for the year preceding the purchase.

- Bank account details.

- Proof of disability, if applicable.

The electric bike conversion bonus

Since July 26, 2021, under certain conditions, it is possible to receive a conversion bonus when purchasing or renting an electrically assisted bicycle (EAB) in exchange for scrapping an old diesel or gasoline vehicle.

Any adult resident of France (only one application per person is permitted) or any legal entity with an establishment in France is eligible to receive a conversion bonus. This bonus is granted for the purchase or long-term rental of an electric bicycle. The financial assistance offered by the State corresponds to 40% of the purchase price, capped at €1,500. However, this ceiling can reach €3,000 under certain conditions. The conversion bonus can be combined with the bicycle bonus.

Terms

Applicant's characteristics:

- He must be of legal age and domiciled in France

- For the highest aid bracket : have an income per tax share not exceeding €7,100 (if you buy the bike in 2024, you must show the 2023 tax notice on 2022 income) or be disabled.

- For the lowest aid bracket : have a taxable income per share below €24,900 (with the same conditions on tax notices as for the higher bracket) or be a person with a disability.

Features of the new bike:

- The bike must not have a lead-acid battery.

- A unique identifier must be affixed to the bicycle frame.

- The bicycle must operate with a pedal-assist system.

- In the case of a rental, it must last at least two years.

Characteristics of the vehicle to be scrapped:

- The vehicle must be a private car (VP) or a van (CTTE).

- Must be first registered before 2006 for a petrol vehicle or first registered before 2011 for a diesel vehicle.

- Be handed over for destruction within 3 months before or 6 months after the invoicing of the new vehicle

- You must have owned it for at least 1 year.

Amounts

The amount of the conversion bonus for the purchase of a bicycle is set at 40% of the cost of the bicycle up to a limit of €1,500.

This amount is increased to €3,000 if the individual can prove taxable income per share of less than €7,100.

Request it

To apply for the conversion bonus, go to https://www.primealaconversion.gouv.fr . There you will find a form to fill out with your personal information and the details of your new electric bike.

In order to complete your file, you will need to provide the following documents: a copy of the bicycle invoice, the registration document for your old vehicle, proof that the old vehicle has been destroyed and a sworn statement certifying that you have owned the vehicle for at least one year.

Grants at the local level

Combined with state aid, there are subsidies for the purchase of an electric bicycle (e-bike) at the local level. This means that not everyone is entitled to them in the same way; it depends on what is offered where you live. To claim this aid, contact your local authority, town hall, department, or region.

Several regions, such as Île-de-France, Occitanie, Grand Est, Pays de la Loire, and Corsica, have launched such initiatives. Many large cities are also encouraging the development of environmentally friendly transportation. Examples include Paris, Nice, Toulouse, Strasbourg, and Lille.

For specific information on the assistance available depending on your place of residence, go to https://mesaidesvelo.fr/ .

These incentives and policies for soft mobility are subject to change at any time. Before purchasing an electric bike, remember to contact your local town hall, department, or region for more information.

In the meantime, let's detail some examples below!

Aid from the Lyon Metropolis

The Lyon Metropolitan Area offers financial assistance to encourage the purchase of bicycles. This grant, which can amount to up to €1,000, is limited to 50% of the total purchase price, including tax, except for reconditioned second-hand bicycles. It is available to anyone residing in one of the 59 municipalities of the Metropolitan Area who has not received this assistance in the last four years. The amount of the grant is adjusted according to the applicant's taxable income and tax share.

Assistance from the Lyon Metropolis for the purchase of bicycles covers four main categories:

- Electrically assisted bicycles or electrification kits: These bicycles, new or used, are eligible as long as they do not exceed 3,200 euros and do not use a lead-acid battery or are not "speed bikes" exceeding 25 km/h.

- Cargo bikes , family bikes, and bikes for people with reduced mobility or disabilities, including two-wheelers, three-wheelers, parent-child tandems, and adapted bikes. There is no price limit for these bikes, and they can be purchased new or used.

- Folding bikes , with or without electric assistance, provided the price does not exceed 3200 euros. These bikes can be purchased new or used.

- Reconditioned used bicycles : The total price, including the lock and membership fees, must not exceed €150. These bicycles must be purchased second-hand from organizations engaged in reuse and reconditioning.

Where to buy your bike?

To qualify for assistance from the Lyon Metropolitan Area for the purchase of a bicycle, you must purchase it from a professional retailer located within the Lyon Metropolitan Area. However, for bicycles intended for people with reduced mobility or disabilities, purchases can be made throughout France or via websites offering home delivery. With the exception of these adapted bicycles, online purchases are not permitted to qualify for assistance.

To simulate and/or directly complete your financing request online, go to the Toodego website.

Aid from the Nantes Metropolitan Area

In 2024, Nantes and its 24 associated municipalities will offer financial assistance for the purchase of electric bikes. However, this opportunity is reserved for adults with a household income not exceeding €900 per unit. Let's break down what this means for your wallet:

- Your family quotient (QF) is less than or equal to €350: you are eligible for assistance covering 90% of the cost of the bike, up to €800.

- QF between €351 and €500: 70% of the purchase is subsidized, capped at €500.

- QF between €501 and €750: 50% of the purchase is subsidized, with a limit of €250.

- QF between €751 and €900: 30% of the purchase is subsidized, up to €150.

These subsidies apply to the purchase of a new or used electric bike, provided it is purchased from a professional. They also extend to an electrification kit and essential anti-theft and marking equipment, if purchased at the same time.

To claim this aid, apply online or by post. Don't forget to gather the required documents: ID, bank details, invoice for the bike or accessories, recent proof of address, proof of your financial situation and the bike's NF EN 15194 approval certificate. All the details are on the Nantes city website .

Grants from the Bordeaux Metropolitan Area

Residents of the 28 municipalities of the Bordeaux metropolitan area are eligible for a grant to purchase an electric bicycle, subject to income testing. The amount allocated is €100, with one key condition: your bike can be purchased before the application, but it must be less than one year old.

This financial assistance extends to different types of purchases:- Classic electric assist bicycle

- Electric tricycle

- Folding bike

- Cargo bike

- Device to convert a standard bicycle into an electric bicycle

To be eligible, you must reside in one of the 28 municipalities of the metropolis and have a family quotient not exceeding €2,200.

To apply, go to https://mesdemarches.bordeaux-metropole.fr/ with all the required supporting documents, the list of which is available in the grant regulations.

Are you starting to get lost? Let's summarize,

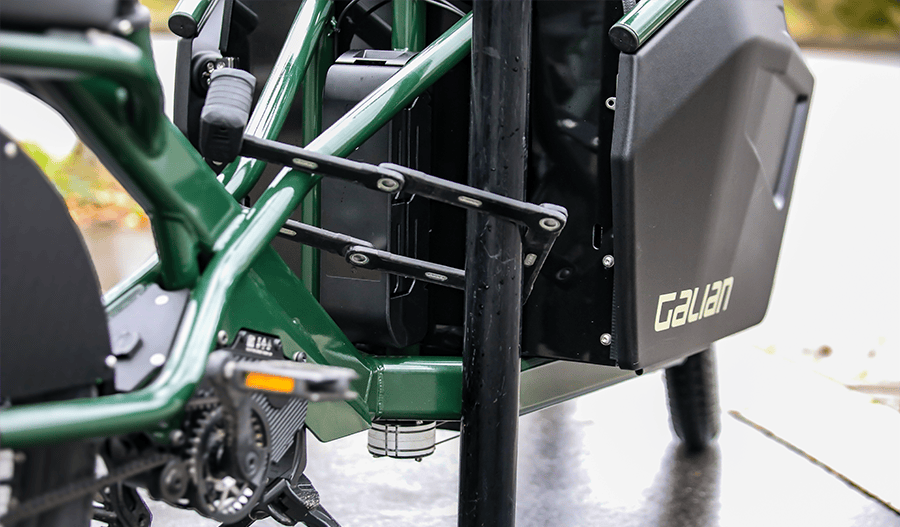

Galian and Taalweg are partnering to help you finance your Le Formidable - Galian electric cargo bike. Run a financing simulation here .

After this overview of financial aid from the State and local authorities, let's take stock of aid for professionals to acquire bicycles.

Professionals: an update on aid and tax reductions

Buying an electric bike with your company: the tax advantages

Businesses can deduct bicycle-related costs from their profits, provided they have a justified benefit to the company's business. This includes speed and ease of travel. There is no fixed price limit, but the expense must be consistent with the company's needs. Ancillary costs such as locks, helmets, bags, and insurance are also deductible, as they are considered necessary safety features.

Furthermore, since 2019 and until December 31, 2024, a corporate tax reduction applies to companies that provide their employees with a fleet of bicycles free of charge. This reduction is equivalent to 25% of the costs incurred for the purchase, rental, or maintenance of the bicycles.

It is important to note that if the corporate tax reduction exceeds the corporate tax due, there will be no refund, as it is a reduction and not a tax credit .

Local and national aid for the purchase of bicycles by companies

Various local authorities offer local grants for the purchase of electric bikes, which vary depending on your business location. Depending on your location, the amount can reach up to €500 for an e-bike and up to €1,200 for a cargo bike.

There is also a national eco-bonus, but companies cannot use it to purchase an electric bicycle.

In addition, for the purchase of a new or used electric bike, whether as a legal entity (for your business) or an individual (personally), to replace a polluting vehicle (Crit'Air 3 or higher), you can claim the conversion bonus. This bonus can reach up to €3,000, under certain conditions.

Buying a bike: accounting and VAT

With or without electric assistance, bicycles, like other personal or multi-purpose means of transport, do not benefit from the deductibility of Value Added Tax (VAT). The purchase of a bicycle, considered a fixed asset, is recorded as "transport equipment" in a company's accounting. This classification implies that its cost is depreciated over several years (between 3 and 5 years), rather than being fully accounted for in the year of its acquisition.

Unlike some consumer goods, VAT paid on the purchase of bicycles, as well as their spare parts and accessories, cannot be recovered.

Regarding the VAT rate applicable to electric bicycles, although the idea of a reduction was raised, it was never implemented. Thus, conventional or electric bicycles are subject to the general rate of 20%.

The exception of utility electric cargo bikes

An exception is made, however, for electric cargo bikes intended for "utility" uses. These, whether electric or not, can benefit from VAT deductibility if they are equipped for specific tasks such as urban delivery, pallet transport or waste collection, provided they are equipped with the necessary accessories (which is the case with Galian's longtail cargo bikes!).

Therefore, if a cargo bike is used exclusively professionally for operations subject to VAT and equipped accordingly, the VAT charged on its purchase can be deducted.

Galian and Taalweg are partnering to help you finance your Le Formidable - Galian electric cargo bike.Run a financing simulation here .

Can my employer help me purchase an electric bike?

Currently, there is no specific financial support from employers for the purchase of an electric bicycle. However, some companies or works councils offer assistance to their employees.

However, if you own a bicycle (electric or not) and use it for your home-work journeys, you could benefit from the sustainable mobility package , provided that your company has opted for this measure. This aid is available whether or not you received national or local aid for the purchase of your bicycle.This scheme replaces mileage allowances and is voluntary. If your employer chooses the sustainable mobility package:

- your business trips by bike are covered up to a ceiling of €800 per year.

- the amount and conditions of the aid are determined by the employer.

- the compensation received in this context is tax-exempt.

Note: The sustainable mobility allowance can reach a maximum amount of €800 per year per employee, without being subject to taxes or social security contributions. This €800 amount is applicable when the employee combines the allowance with a public transport pass. Otherwise, the maximum amount is €700. If an employer grants an amount exceeding €800, the excess amount will be subject to tax and social security contributions.

Buy your bike with an advantageous loan

Purchasing an electric bike is becoming more accessible than ever. For several months now, several banks have been offering favorable loan rates, including 0% bike loans.

For example, Crédit Mutuel bank, with its "0% bike loan for all" initiative, facilitates access to active means of transport, including electric cargo bikes , for individuals and businesses. The loan repayment, which can reach €6,000 for individuals and €10,000 for businesses, can be spread over a period of 3 to 48 months. Customers will be able to choose from a wide range of new or used bikes. This scheme is available until December 31, 2024.

Various banks offer consumer loans at attractive rates for the purchase of an electric bike, so start by checking with your bank!

Finally, there are a number of grants and subsidies available for purchasing an electric bike. Whether you're an individual or a professional, the conversion bonus applies. Then, depending on where you live and your reference tax income, the amount of aid varies. Contact your local government department for a personalized study.

Galian and Taalweg are partnering to help you finance your Le Formidable - Galian electric cargo bike.Run a financing simulation here .

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.